Blockchain made its debut when Bitcoin was introduced to the world as a peer to peer version of electronic cash in 2009. While Blockchain cannot be discussed without reference to Bitcoin – Bitcoin is just one of the several hundred applications that use blockchain technology.

So what is Blockchain?

Blockchain is exactly what the name means– a technology that allows blocks of information to be created and stored in a chain.

A blockchain is a singly linked list of blocks, with each block containing number of transactions and assets in a business network. An asset can be tangible e.g. land, a car, cash, or intangible such as patents, copyrights, or branding.

It provides a decentralized, immutable data store – that can be used across a network of users, create assets and act as a shared book that records all transactions. Each transaction or “block” is transmitted to all the participants in the network and must be verified by each participant “node” solving a complex mathematical puzzle. Once the block is verified, it is added to the ledger or chain of blocks – affording greater transparency and trust to all parties involved. From the standpoint of information, the real advancement of this distributed ledger technology is that it ensures the authenticity of the ledger by crowdsourcing oversight and removes the need for a middlemen or any central authority. It also provides answer to digital trust as-

- it records important information in a public space and does not allow anyone to remove it;

- it is transparent, time-stamped, and decentralized.

Blockchain is viewed as “near unhackable,” because transactions/information are verified and validated by multiple computers that host the blockchain. Besides to alter any data or information – a cyber-attack would have to strike (nearly) all copies of the records simultaneously.

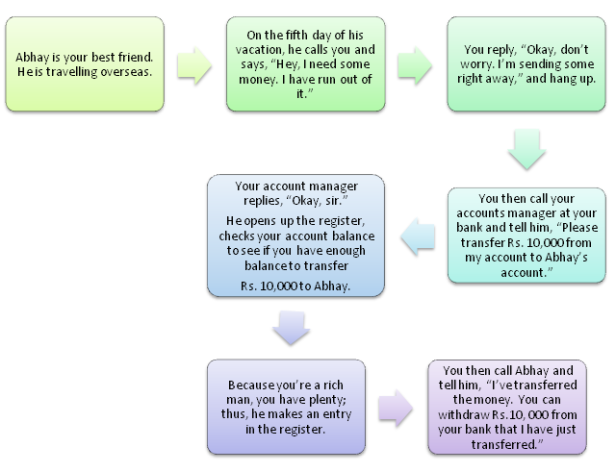

Why do we need something this complex? Let us read through the below example.

So what happened here?

You and Abhay both trusted the bank to manage your money. There was no movement of physical bills during money transfer. An entry in the register was all that was needed.

This is the problem with the current systems.

To establish trust between ourselves – we depend on individual third-parties.

- We deposit monies with banks because we trust them.

- We borrow money from them because we trust them.

- We know if there are problems, the banks will “do the right thing”.

You might ask, “What is the problem depending on them?”

The problem is that they are singular in number.

What if that register in which the transaction was logged gets burnt in a fire?

What if, by mistake, your account manager had written Rs.15, 000 instead of Rs.10, 000?

What if he did that on purpose?

Could there be a system where we can transfer money without needing a bank?

Now, if this trust can be replaced by a technology – it has the potential to reduce the role of banks, lawyers, auditors, accountants and all.

How a Blockchain works?

A blockchain retains a growing list of records chronologically in a decentralized\distributed database where the storage devices for the database are not linked to a common processor (centralized) but distributed between multiple processors called nodes.

It maintains a complete and increasing number of the transactions which are grouped into blocks so that every individual in the network can see it or be aware of.

Now things get attractive. A block, which is a data structure/ record where data or transactions are permanently recorded and maintained – can be added to the chain if all nodes (individuals) in the network concur to add the next valid block to the chain.

The validity of the new block is determined by the first miner node – the one that solves an extremely complex algorithm (and then is rewarded).

Once data is entered into the network, it is really hard to modify or hack the information for two reasons:

- Firstly, this technology uses cryptography to make sure that users of the network can only edit the part of the network which they own through a private key necessary to modify the block.

- Secondly, immutability of the network is established by the fact that every block includes the hash of the previous block – so any effort to alter or modify a transaction can be easily observed by the complete network.

In short, each block contains–

- hash of the previous block,

- a time stamp (date and time of the transaction),

- Proof of Work (work done by the miners to validate the transaction), and

- a summary of the transaction.

A Blockchain network can be private (requires permission to join) or public (permission less).

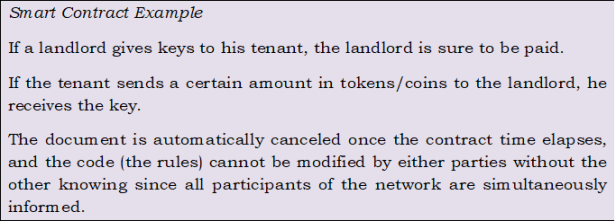

Smart Contracts in Blockchain

Smart contracts are agreements between two or more parties of a network whose execution is mechanized by a computer-generated program.

Smart contracts can help people exchange money, property, or anything that has value, in a transparent way without the need of any intermediary. (e.g. banks, accountants, etc.).

The system works on the “If this happens, then…” principle and is viewed by the whole network, resulting in a secure flawless transaction.

Legal Issues / Challenges in Blockchain

- Distributed Jurisdiction

Blockchain is a distributed data structure where nodes are potentially situated in different parts of the world. As a result identification of a competent jurisdiction and applicable laws can be complex. Thus, the insertion of an exclusive governing law and jurisdiction clause is essential to ensure that a user has legal certainty to the law to be applied for determining the rights and obligations of the parties to the agreement and the courts to handle disputes, if any.

- Intellectual Property Rights

The IPR issues which can arise are similar to ones that are for open source software projects. Conflict of interests (between the Investor and User) over the Intellectual Property Rights are bound to happen and legal frameworks including IP will need to keep pace with such challenges.

- Data Protection Regulations

As we have seen in a blockchain , once data is stored it cannot be modified (at least, not easily), having implications for data privacy, specifically where the data is sufficient to disclose someone’s personal details.

This is also in direct conflict with GDPR that states the right of a data subject to obtain the erasure of personal data from a data controller concerning him/her. Hence, technology-based solutions need to be found to design privacy-protecting blockchains.

- The Enforceability of Smart Contracts needs to be made simpler

Smart Contracts that simply codes a particular process but do not include, or operate in combination with contractual terms – may not fulfill requirements of certainty, as required in Contract Law.

Also, for a legally binding contract offer and acceptance is mandatory. In a Smart Contract, these two elements are sometimes ambiguous creating uncertainties.

- Due diligence on blockchain

Lawyers who are tasked with performing due diligence on the buy and/or sell side in connection with these investments need to comprehend blockchain technology and the upcoming business models based on the technology. There will be unique issues concerning ownership of data residing on decentralised ledgers and intellectual property ownership of blockchain-as-a-service offerings operating on open source blockchain technology platforms.

- Compliance with financial services regulation

Many sourcing arrangements require regulatory bodies to incorporate relevant contracts – a series of provisions that speak about exercising control, and gaining operational continuity. With blockchain, this may be a challenge. The contracts and overall agreements would need to be carefully reviewed to ensure compliance, as needed.

This article has been authored by Deepali Kharbanda from Team LawSkills.

To enroll for a free certification course on Blockchain Technology and become an industry expert, click here!

To read our guide on Blockchain Technology for amateurs, click here.